tax strategies for high income earners canada

For the nations highest-income earners those making more than 220000 annually the amount. Registered Retirement Savings Plan RRSP RRSP is a great opportunity for high-income individuals to save on taxes.

10 Tax Planning Strategies For High Income Earners Gamburgcpa

A donor-advised fund DAF is an investment account created to support.

. The more money you make the more taxes you pay. It will help you reduce the taxes. If you are an employee.

The math is simple. The first way you can reduce your taxable income and therefore your tax on that income is through additional superannuation. Your best bet is to.

Either way it is beneficial to take advantage of the tax-reducing benefits of these accounts by contributing maximum income to reduce the tax burden. When personal income exceeds 200000 in canada the earner has to pay taxes at a rate of 50 or higher depending on the province of residence. Tax Planning Strategies for High-income Earners.

6 Tax Strategies for High Net Worth Individuals 1. The RRSP can be a great way for higher-income earners to get a hefty tax return but can also be a way for Canadians in any tax bracket to pay less money to the government. Overview of Tax Rules for High-Income Earners.

For high-income earners charity contributions often generate more tax savings compared to low-income earners. Here are 50 tax strategies that can be employed to reduce taxes for high income earners. The top bracket is.

To prevent passive investment income unrelated to the active nature of the business from being unduly spared from taxation the CRA has put a policy in place that will. However lawmakers change tax codes regularly both temporarily and permanently. For higher-income earners income splitting redirecting income within a family unit can be one of the most powerful tools for families to reduce their tax burden and keep.

2 As a refresher for 2021 fy the individual tax rates including. Lets start with an overview of tax rules for. With your qualified tax advisor.

Eliminate the 20 percent long-term capital gains tax rate and replace it with the 396 percent ordinary income tax rate for individuals whose adjusted gross income exceeds 1. 50 Best Ways to Reduce Taxes for High Income Earners. However tax-deferred accounts can be an effective tax strategy for high-income earners to reduce current year tax liabilities.

You must consider investing in RRSP and make contributions from your taxable income. Max Out Your Retirement Account. The SECURE ACT includes several key changes that affect tax reduction strategies for high-income earners.

Moreover funds in RRSP grow on a. Taking advantage of all of your allowable tax deductions and credits. Because it allows you to take current and future year contributions.

Tax minimization strategies for. Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account. Additionally tax-deferred accounts benefit by.

Knowing the right tax reduction strategies for high-income earners is key to lowering your income taxes. How to Reduce Taxable Income. Tax Planning Strategies for High-income Earners.

Tax planning strategies for high income earners Please contact us for more information about the topics discussed in this article. Here are some of our favorite income tax reduction strategies for high earners. Tax deductions are expenses that can be deducted from your taxable.

Many wealthy Canadians run a side business or their own business for the benefits of lower tax rates business write-offs and tax-deductible individual pension. What follows are tax strategies that some high-income earners utilize. Consider a 500 donation from a high earner in the 37 tax bracket and a.

Using a donor-advised fund DAF is probably one of the best tax strategies for high income earners.

52 Week Money Challenge For Incomes Under 25000 A Year Etsy Money Challenge 52 Week Money Challenge Money Saving Strategies

How To Reduce Taxes For High Income Earners In Canada

How To Reduce Taxes For High Income Earners In Canada

7 Best Tips To Lower Your Tax Bill From Turbotax Tax Experts Turbotax Tax Tips Videos

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

How The Tax Burden Has Changed Since 1960

8 Ways To Help Lower Clients Taxes And Boost Their Retirement Savings Advisor S Edge

Personal Income Tax Brackets Ontario 2020 Md Tax

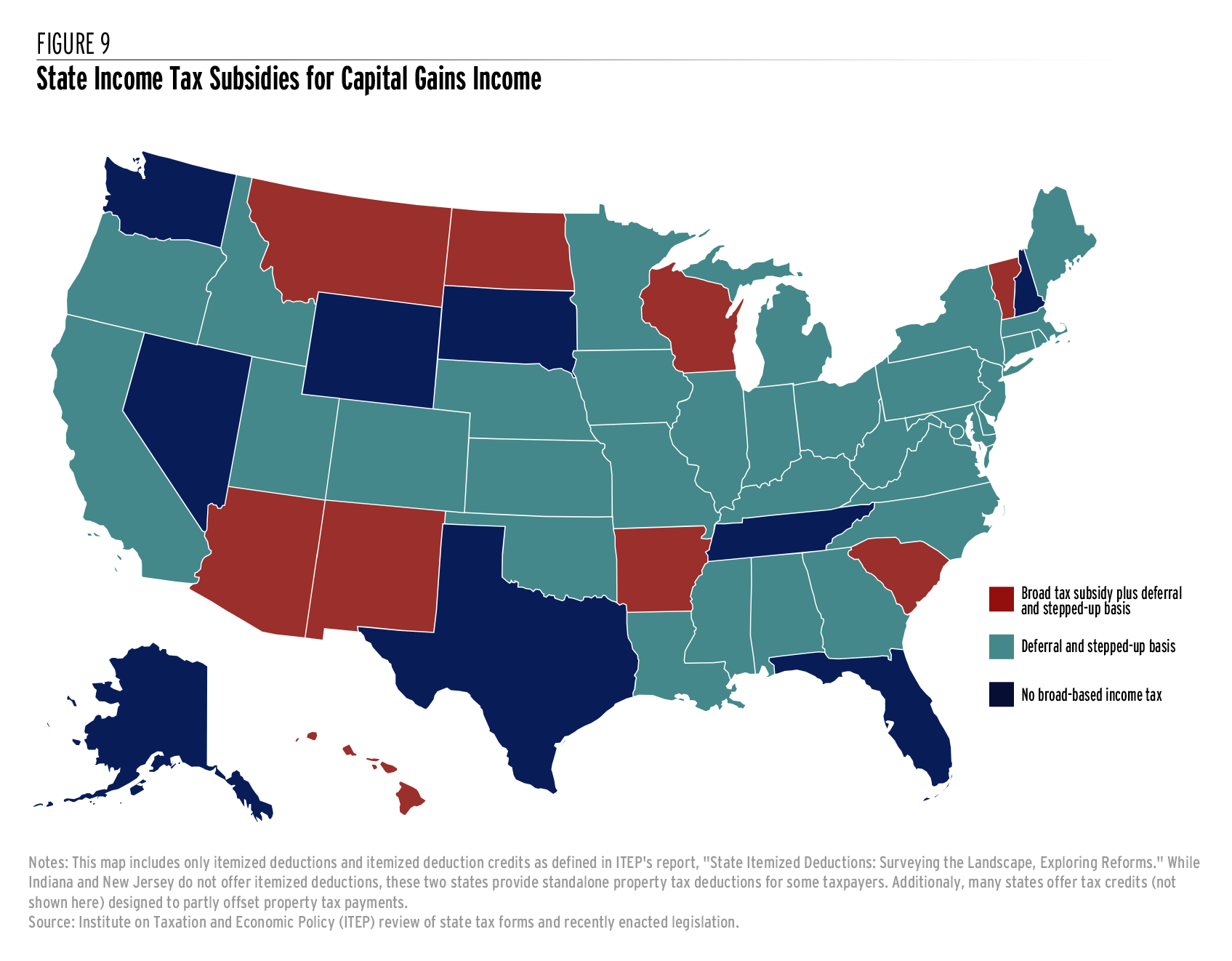

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Pin On Advanced Financial Planning

How Do Taxes Affect Income Inequality Tax Policy Center

What Are Real Assets And How To Diversify Your Wealth By Investing In Them Investing Diversify Business Management

High Income Earners Need Specialized Advice Investment Executive

Proposed Tax Changes For High Income Individuals Ey Us

Tax Planning For High Income Canadians

Tfsa Vs Rrsp How To Choose Between The Two 2022 Canadian Money Retirement Advice Finance Blog